There’s something completely new happening with gold that I believe will completely change how people own it and view it.

I know I’ve mentioned it in passing, but Tether (the world’s largest crypto firm) has been quietly and quickly creating a gold backed stablecoin called Tether gold.

Crypto people frequently deride gold for being expensive and difficult to transfer – which is somewhat true. If you’ve ever bought gold coins through the mail, you know the insurance and shipping can make up a significant chunk of the value of the coins you’re buying.

That’s true also to an extent for large gold shipments – even moving gold from vault to vault in the same complex costs time and money.

But Tether gold is creating something entirely new. I wrote about this phenomena in my latest issue of Golden Portfolio IV:

“Imagine gold that works like PayPal or Zelle. You could control it from your phone, send it to anyone instantly, use it to pay a bill, or cash it in for groceries. Not a coin gathering dust in your safe. Real gold, backed by bars in a vault, available at your fingertips. This is happening right now, and it is transforming the gold market for the first time in fifty years.

I saw the future of gold play out at a small private dinner during the Beaver Creek gold Conference. The table was crowded with heavyweights. Juan Sartori, head of special business development at Tether. Randy Smallwood, the CEO of Wheaton Precious Metals. Paul Brink, the CEO of Franco-Nevada. And me.

These are the kind of people who speak plainly and let the numbers do the talking.

Over drinks, Sartori leaned in and dropped the bombshell. “We are buying two tons of gold per week.”

Two tons. Every week.

That’s fifty-eight thousand ounces. At a $3,700 gold price, it comes to $216 million worth of gold, week in and week out.

Over $11 billion a year.

For context, that’s as much as China, the largest gold buyer in the world. And it’s not a rumor. It is happening. Tether is taking down that much physical gold, loading it into its own vaults in Switzerland, and removing it from the Wall Street system entirely.

Recent US Crypto legislation will drive an astronomical amount of USD assets into gold backed crypto stablecoins. Tether is cornering the world’s gold market.

That’s why the gold price has been so strong, because Tether demand is allowing gold to trade on true supply and demand for the 1st time in over 50 years. Trump and Bessent are going to lower rates to 1%.

Miran on the Fed wrote the Mar-A-Lago Accord about how a lower dollar will drive economic growth. Assets are going to avalanche out of the USD into gold as dollar devaluation is guaranteed. The US embraced Crypto last week passing the Genius act. They believe crypto will provide demand for US debt. Trump and Bessent are wrong.

Crypto holders hate the USD, and will never hold an asset guaranteed to be devalued. Just like many World Central banks who are buying gold instead of US debt. Mr. Sartori then winked, ”We haven’t seen anything yet. Tether gold is going to be bigger than Tether USD”.

Tether USD holds $172 bil, and Tether gold only holds $1.4 bil. That’s more than 100X growth. Mr. Sartori knows the masses are coming, and he’s getting prepared for a massive influx of capital making gold connections at Beaver Creek.

Also, many of the World’s Central banks are buying gold instead of Treasuries never to return to the USD. There are fundamental forces in play driving gold demand that are truly “different this time”. Crypto holders don’t want USDs even at 5% yield. That’s why Crypto was invented as a USD alternative with fixed quantity. When Trump and Bessent cut rates to 1% Crypto holders will rush out of Tether USD and into Tether gold. Bitcoin and gold are often compared due to fixed amount qualities that make both solid stores of value. But BTC isn’t backed by anything.

Gold is the backing, and Tether gold is the amalgamation of the best of both worlds with the frictionless easily transferable qualities of crypto technology tied to gold’s store of value.”

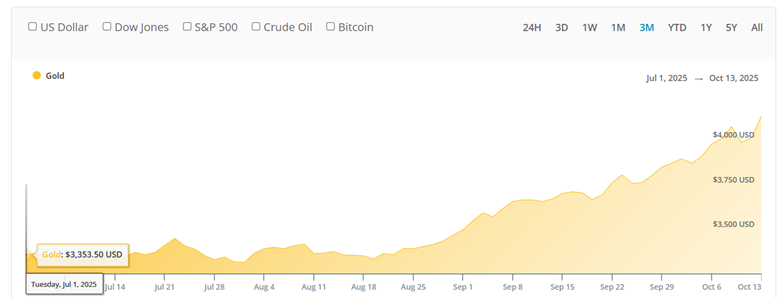

Also remember, this past July 1st, Basel III went live, and overnight gold vaulted to a Tier 1 asset that financial institutions can hold at 100% of value. Before July, gold was only valued at 50% of its value on the balance sheet of financial institutions.

Since July, gold has jumped nearly $800 an ounce, from $3,350 to over $4,100…

Central banks have been net buyers of gold for ten years now, leading into Basel III going live in July. Sounds a lot like a revaluation to me.

Invest accordingly.

Best,

Garrett Goggin, CFA, CMT

Chief Analyst & Founder, Golden Portfolio